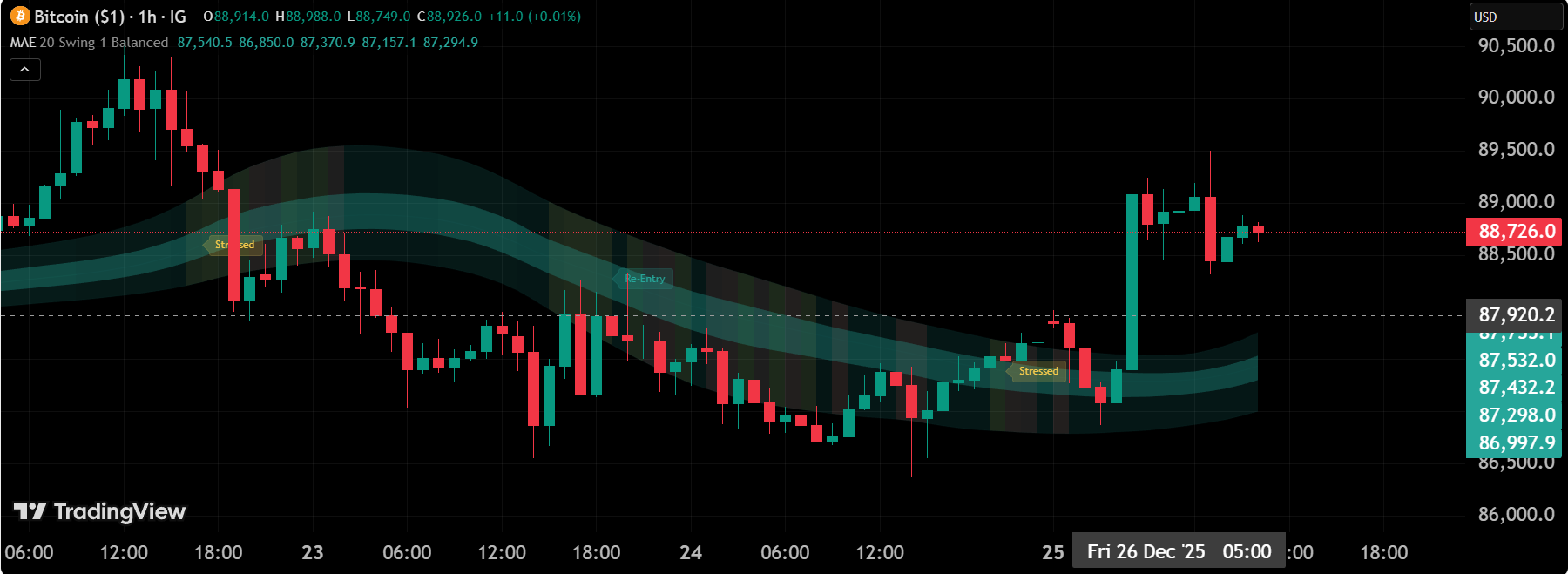

Market Acceptance Envelope [Interakktive]

A dynamic envelope system that identifies institutional acceptance zones through probabilistic boundaries. Quantifies where price "belongs" based on statistical acceptance thresholds, revealing genuine support/resistance levels formed by market consensus rather than arbitrary technical levels.

Key Features

- ✓Probabilistic acceptance boundaries (Bollinger-inspired methodology)

- ✓Dynamic width adjustment based on volatility states

- ✓Multi-standard deviation envelope layers

- ✓Institutional acceptance zone identification

- ✓Real-time boundary breach detection

- ✓Customizable lookback and smoothing parameters

Use Cases

- →Identify high-probability reversal zones at envelope extremes

- →Confirm trend strength when price sustains outside boundaries

- →Detect compression phases when envelope narrows

- →Validate breakouts when price establishes new acceptance ranges

- →Support mean-reversion strategies in ranging markets

Technical Details

Uses statistical standard deviation bands around a moving average baseline, with adaptive width calculations responding to realized volatility. Default: 20-period lookback with 2.0/2.5/3.0 standard deviation multipliers.

Ready to try it?

Add this indicator to your TradingView charts for free. No signup required.

Open on TradingViewExplore More Indicators

Market State Intelligence

A multi-dimensional regime classifier that synthesizes trend, momentum, volatility, and structure into unified market state intelligence. Provides real-time regime detection enabling traders to adapt strategies to current market conditions rather than applying static approaches across all environments.

Learn more →Market Acceptance Zones

Identifies institutional acceptance levels where significant volume concentration and price equilibrium occurs. Maps horizontal zones representing areas of sustained interest rather than transient price levels, revealing where smart money has established positions.

Learn more →