Free Indicators

Professional-grade trading indicators available for free on TradingView. No signup required - add them to your charts instantly.

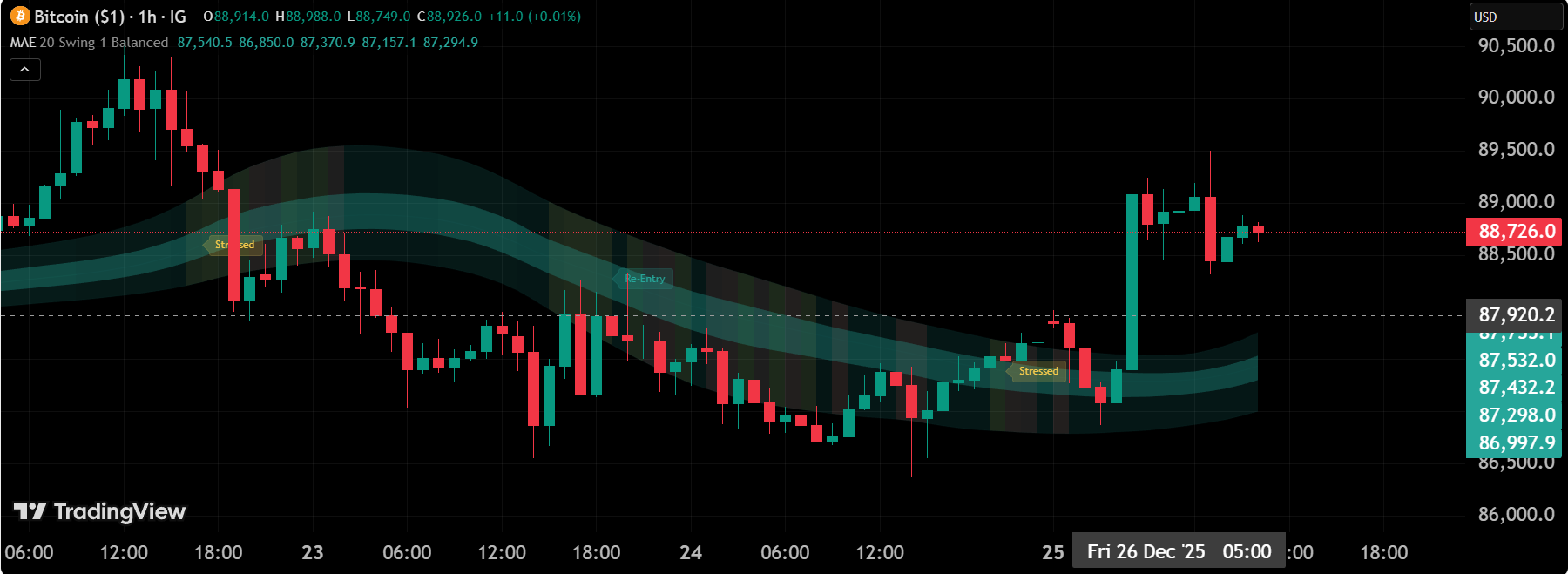

Market Acceptance Envelope

Add to ChartA dynamic envelope system that identifies institutional acceptance zones through probabilistic boundaries. Quantifies where price "belongs" based on statistical acceptance thresholds, revealing genuine support/resistance levels formed by market consensus rather than arbitrary technical levels.

Key Features:

- •Probabilistic acceptance boundaries (Bollinger-inspired methodology)

- •Dynamic width adjustment based on volatility states

- •Multi-standard deviation envelope layers

Market State Intelligence

Add to ChartA multi-dimensional regime classifier that synthesizes trend, momentum, volatility, and structure into unified market state intelligence. Provides real-time regime detection enabling traders to adapt strategies to current market conditions rather than applying static approaches across all environments.

Key Features:

- •Four-dimensional state analysis (Trend, Momentum, Volatility, Structure)

- •Real-time regime classification system

- •Composite market state scoring

Market Acceptance Zones

Add to ChartIdentifies institutional acceptance levels where significant volume concentration and price equilibrium occurs. Maps horizontal zones representing areas of sustained interest rather than transient price levels, revealing where smart money has established positions.

Key Features:

- •Volume-weighted acceptance level detection

- •Time-at-price concentration analysis

- •Dynamic zone width based on institutional activity

Market Participation Gradient

Add to ChartTracks the intensity and directional bias of market participation through momentum pressure analysis. Measures whether participation is accelerating (conviction building) or decelerating (conviction fading), revealing the commitment level behind price movements.

Key Features:

- •Momentum pressure intensity measurement

- •Directional participation bias detection

- •Acceleration/Deceleration gradient analysis

Market Pressure Regime

Add to ChartA multi-dimensional pressure state classifier that identifies whether current market conditions favor buyers, sellers, or equilibrium. Synthesizes buying pressure, selling pressure, and equilibrium metrics into actionable regime states for strategy adaptation.

Key Features:

- •Three-dimensional pressure analysis (Buy/Sell/Equilibrium)

- •Real-time regime classification system

- •Pressure intensity scoring (0-100 scale)

Volatility State Index

Add to ChartA comprehensive volatility regime detection system that classifies current market conditions into distinct volatility states. Enables traders to adjust position sizing, stop-loss placement, and strategy selection based on realized volatility environments.

Key Features:

- •Multi-state volatility classification (Calm/Normal/Elevated/Extreme)

- •Normalized volatility scoring (0-100)

- •Historical volatility percentile ranking

Effort-Result Divergence

Add to ChartA Wyckoff-inspired analytical tool that identifies efficiency anomalies by comparing volume effort against price result. Detects conditions where high volume produces minimal price movement (inefficiency) or low volume produces significant movement (abnormal efficiency), revealing potential institutional activity.

Key Features:

- •Volume-Price efficiency ratio calculation

- •Effort-Result divergence detection

- •Institutional activity anomaly identification

Market Efficiency Ratio

Add to ChartA diagnostic tool that decomposes price movement into directional progress versus wasted oscillatory movement. Quantifies what proportion of price's total travel distance represented genuine directional advancement versus sideways chop, enabling traders to differentiate trending efficiency from consolidation waste.

Key Features:

- •Efficiency Ratio calculation (0-100 scale)

- •Net Displacement measurement

- •Path Length tracking (total distance traveled)

Want More Power?

ATLAS PRO combines AI, ML, and multi-timeframe analysis for institutional-grade trading signals.